Pricing Guide

Summary

In short, while it is up to individual procurement departments to set their own prices, we recommend they set the price to be the square root of the order size.

For example, if an RPF was send out for a $1,000,000 order, we recommend the price for the 10min video call to be $1,000.

Motivation & Analysis

How should procurement officers on the VPM price their time? Of course, pricing is fundamentally subject to the balance between supply and demand; however, somewhere between 0.1 to 10 permille (1 in 10000 to 1 in 100) of the average contract value might be a good place to start. For simplicity’s sake, let us call this “fee rate.” There are a few important considerations that affect the fee rate and let us briefly examine them below.

- Business development and sales efforts always consume significant resources, so not all sizes of spending are economical for suppliers to personally engage with. For example, mature offerings such as basic SaaS products like Google Workplace or Microsoft 365 are usually self-service only, unless the buyer is looking for very elaborate customizations that warrant dedicated success personnel.

- Since commercial contracts can differ dramatically by value, it would be fair to claim that the respective sales correspondences incur varying levels of time and resource commitments. In general, the larger the contract, the more complicated the sales process. For the procurement officer, this means spending more time preparing for sales engagements and evaluating different proposals. Therefore, the fee rate should always be positive, and the engagement fee should always increase with the mean contract value.

- With that said, given internal procedures and general logistical overhead, even a small contract worth around $10,000 would incur no more than a few hours of a procurement officer’s time. The marginal cost of time decreases with contract value and additional time spent, so the fee rate itself should be monotonically decreasing.

- These two conditions allow for a wide range of functional relationships between the fee rate (or fee) and the mean contract value, but the simple of which is the square-function y=√x , or put in exponential notation, y=1/2(x)

The Square Root Rule

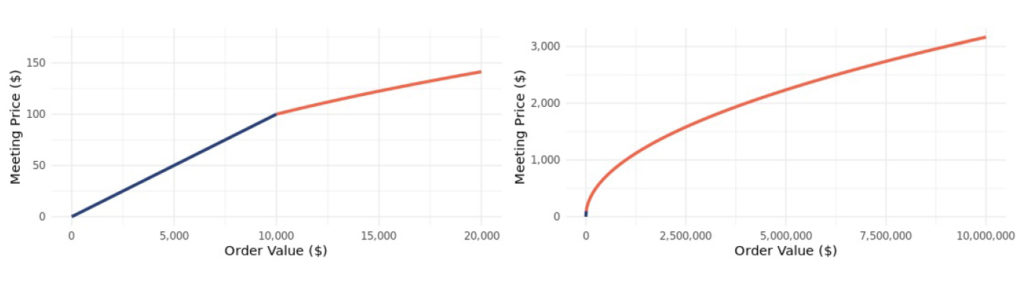

A. Meeting price vs. Order valise for different ranges

B. Price rate chart

For a one million-dollar ($1,000,000) contract, the fee rate will be 0.1%, or one permille, or $1,000.

Summary

| CONTRACT VALUE | $10,000 | $50,000 | $100,000 | $500,000 | $1,000,000 | $5,000,000 | $10,000,000 | $50,000,000 | $100,000,000 |

| 0.4 | 3.981‰ | 1.516‰ | 1.000‰ | 0.381‰ | 0.251‰ | 0.096‰ | 0.063‰ | 0.024‰ | 0.016‰ |

| 0.41 | 4.365‰ | 1.689‰ | 1.122‰ | 0.434‰ | 0.288‰ | 0.112‰ | 0.074‰ | 0.029‰ | 0.019‰ |

| 0.42 | 4.786‰ | 1.882‰ | 1.259‰ | 0.495‰ | 0.331‰ | 0.130‰ | 0.087‰ | 0.034‰ | 0.023‰ |

| 0.43 | 5.248‰ | 2.097‰ | 1.413‰ | 0.564‰ | 0.380‰ | 0.152‰ | 0.102‰ | 0.041‰ | 0.028‰ |

| 0.44 | 5.754‰ | 2.337‰ | 1.585‰ | 0.644‰ | 0.437‰ | 0.177‰ | 0.120‰ | 0.049‰ | 0.033‰ |

| 0.45 | 6.310‰ | 2.604‰ | 1.778‰ | 0.734‰ | 0.501‰ | 0.207‰ | 0.141‰ | 0.058‰ | 0.040‰ |

| 0.46 | 6.918‰ | 2.901‰ | 1.995‰ | 0.837‰ | 0.575‰ | 0.241‰ | 0.166‰ | 0.070‰ | 0.048‰ |

| 0.47 | 7.586‰ | 3.233‰ | 2.239‰ | 0.954‰ | 0.661‰ | 0.282‰ | 0.195‰ | 0.083‰ | 0.058‰ |

| 0.48 | 8.318‰ | 3.602‰ | 2.512‰ | 1.088‰ | 0.759‰ | 0.329‰ | 0.229‰ | 0.099‰ | 0.069‰ |

| 0.49 | 9.120‰ | 4.014‰ | 2.818‰ | 1.240‰ | 0.871‰ | 0.383‰ | 0.269‰ | 0.118‰ | 0.083‰ |

| 0.5 | 10.000‰ | 4.472‰ | 3.162‰ | 1.414‰ | 1.000‰ | 0.447‰ | 0.316‰ | 0.141‰ | 0.100‰ |

| 0.51 | 10.965‰ | 4.983‰ | 3.548‰ | 1.613‰ | 1.148‰ | 0.522‰ | 0.372‰ | 0.169‰ | 0.120‰ |

| 0.52 | 12.023‰ | 5.553‰ | 3.981‰ | 1.839‰ | 1.318‰ | 0.609‰ | 0.437‰ | 0.202‰ | 0.145‰ |

| 0.53 | 13.183‰ | 6.187‰ | 4.467‰ | 2.096‰ | 1.514‰ | 0.710‰ | 0.513‰ | 0.241‰ | 0.174‰ |

| 0.54 | 14.454‰ | 6.894‰ | 5.012‰ | 2.390‰ | 1.738‰ | 0.829‰ | 0.603‰ | 0.287‰ | 0.209‰ |

| 0.55 | 15.849‰ | 7.682‰ | 5.623‰ | 2.726‰ | 1.995‰ | 0.967‰ | 0.708‰ | 0.343‰ | 0.251‰ |

| 0.56 | 17.378‰ | 8.560‰ | 6.310‰ | 3.108‰ | 2.291‰ | 1.128‰ | 0.832‰ | 0.410‰ | 0.302‰ |

| 0.57 | 19.055‰ | 9.538‰ | 7.079‰ | 3.544‰ | 2.630‰ | 1.317‰ | 0.977‰ | 0.489‰ | 0.363‰ |

| 0.58 | 20.893‰ | 10.628‰ | 7.943‰ | 4.040‰ | 3.020‰ | 1.536‰ | 1.148‰ | 0.584‰ | 0.437‰ |

| 0.59 | 22.909‰ | 11.842‰ | 8.913‰ | 4.607‰ | 3.467‰ | 1.792‰ | 1.349‰ | 0.697‰ | 0.525‰ |

| 0.6 | 25.119‰ | 13.195‰ | 10.000‰ | 5.253‰ | 3.981‰ | 2.091‰ | 1.585‰ | 0.833‰ | 0.631‰ |

| CONTRACT VALUE | $10,000 | $50,000 | $100,000 | $500,000 | $1,000,000 | $5,000,000 | $10,000,000 | $50,000,000 | $100,000,000 |

| 0.4 | $40 | $76 | $100 | $190 | $251 | $478 | $631 | $1,201 | $1,585 |

| 0.41 | $44 | $84 | $112 | $217 | $288 | $558 | $741 | $1,434 | $1,905 |

| 0.42 | $48 | $94 | $126 | $247 | $331 | $651 | $871 | $1,712 | $2,291 |

| 0.43 | $52 | $105 | $141 | $282 | $380 | $760 | $1,023 | $2,044 | $2,754 |

| 0.44 | $58 | $117 | $158 | $322 | $437 | $886 | $1,202 | $2,441 | $3,311 |

| 0.45 | $63 | $130 | $178 | $367 | $501 | $1,034 | $1,413 | $2,914 | $3,981 |

| 0.46 | $69 | $145 | $200 | $418 | $575 | $1,206 | $1,660 | $3,480 | $4,786 |

| 0.47 | $76 | $162 | $224 | $477 | $661 | $1,408 | $1,950 | $4,154 | $5,754 |

| 0.48 | $83 | $180 | $251 | $544 | $759 | $1,643 | $2,291 | $4,960 | $6,918 |

| 0.49 | $91 | $201 | $282 | $620 | $871 | $1,916 | $2,692 | $5,922 | $8,318 |

| 0.5 | $100 | $224 | $316 | $707 | $1,000 | $2,236 | $3,162 | $7,071 | $10,000 |

| 0.51 | $110 | $249 | $355 | $806 | $1,148 | $2,609 | $3,715 | $8,443 | $12,023 |

| 0.52 | $120 | $278 | $398 | $919 | $1,318 | $3,044 | $4,365 | $10,080 | $14,454 |

| 0.53 | $132 | $309 | $447 | $1,048 | $1,514 | $3,552 | $5,129 | $12,035 | $17,378 |

| 0.54 | $145 | $345 | $501 | $1,195 | $1,738 | $4,144 | $6,026 | $14,370 | $20,893 |

| 0.55 | $158 | $384 | $562 | $1,363 | $1,995 | $4,835 | $7,079 | $17,157 | $25,119 |

| 0.56 | $174 | $428 | $631 | $1,554 | $2,291 | $5,642 | $8,318 | $20,484 | $30,200 |

| 0.57 | $191 | $477 | $708 | $1,772 | $2,630 | $6,583 | $9,772 | $24,458 | $36,308 |

| 0.58 | $209 | $531 | $794 | $2,020 | $3,020 | $7,681 | $11,482 | $29,201 | $43,652 |

| 0.59 | $229 | $592 | $891 | $2,304 | $3,467 | $8,962 | $13,490 | $34,865 | $52,481 |

| 0.6 | $251 | $660 | $1,000 | $2,627 | $3,981 | $10,456 | $15,849 | $41,628 | $63,096 |